Simplify CBAM compliance with intelligent automation

Centralize data management, forecast carbon costs with advanced analytics, and optimize procurement strategies—all in one platform.

Everything you need for CBAM success

Comprehensive tools designed specifically for importers to streamline compliance and optimize costs

Centralized CBAM Data Management

- Invite your organisation to collaborate on CBAM

- Upload and manage data related to suppliers, factories, and imported goods in one place

- Manage data for multiple importers when acting as an indirect customs representative

- Link with your ERP system to automatically update CBAM-relevant imports and their emissions

Streamlined Reporting & Analytics

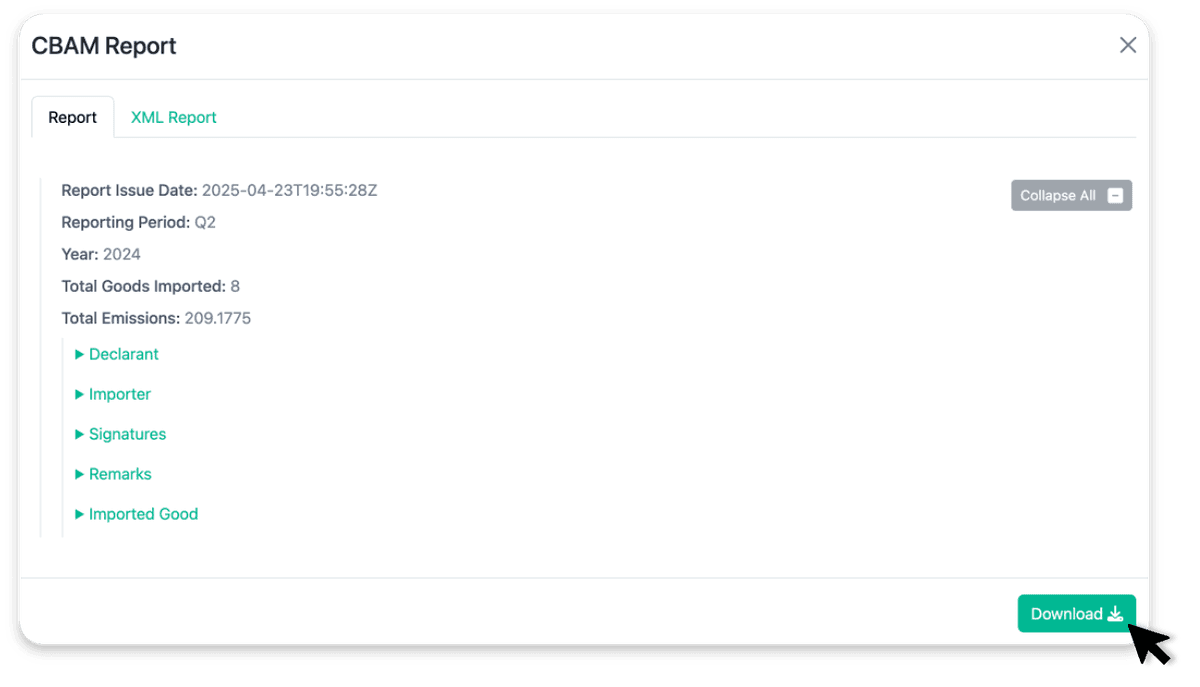

- Generate fully compliant CBAM reports in just a few clicks

- Continuously monitor CBAM-related emissions and costs, with side-by-side comparisons of actual data versus default values

- Model multiple CBAM cost scenarios and explore hedging strategies to proactively manage financial risks.

- Compare carbon costs across suppliers and commodities to inform your procurement strategies

Ensure Supply Chain Readiness

- Request and connect emissions data directly from suppliers

- Automatically track and resend data requests to suppliers — ensuring higher response rates and no missed deadlines

- Empower your suppliers with access to our intuitive, factory-level carbon accounting tool fully aligned with the EU CBAM methodology

- Monitor the quality of supplier data over time to minimise the use of default values

Solutions tailored for every department

Whether you're in customs, finance, sales, or procurement, Carbon Glance has you covered

Customs & Compliance

Mitigate CBAM non-compliance risks: Centralize all required data and streamline CBAM reporting in one compliant platform.

Get StartedAre your imports covered by the EU CBAM?

Check it out now with our CN code checker

Frequently Asked Questions

Get answers to common questions about CBAM compliance for importers

What is the de minimis threshold under CBAM?

Importers are exempt from all CBAM obligations — including reporting, authorisation, and certificate purchases — if their annual imports of covered goods total less than 50 tonnes (cumulative net mass) per CBAM Declarant per year.

How often do I need to report under CBAM?

During the transitional period (October 2023 – December 2025), CBAM reporting is required quarterly.

Starting from January 2026, the definitive period begins, and reporting will become annual.

Do I need to be authorised to import CBAM goods during the definitive period?

Yes, During the definitive CBAM period, importers must be authorised CBAM declarants to continue importing CBAM goods. Without authorisation, imports will be blocked by customs authorities, and importers may face significant penalties.

When do I need to start paying for my CBAM emissions?

CBAM payments will begin in February 2027, covering emissions embedded in imports made during 2026.

The financial obligation starts with the definitive CBAM phase, making it essential to track emissions accurately right from the start.

Do I need to collect emissions data from suppliers, or can I use default values?

While default emission values will be allowed during the definitive period, they will be set higher than actual emissions data collected from suppliers. As a result, relying on default values will be more expensive and less accurate, making supplier-level emissions data the smarter option for cost-effective CBAM compliance.

Ready to take full control of CBAM?

Start using Carbon Glance today to stay ahead in the evolving CBAM landscape